The deBridge Foundation is excited to introduce the deBridge Reserve Fund: an initiative focused on supporting the utility and sustainability of the DBR economy, aligning protocol earnings with ecosystem needs, and improving transparency for the entire community.

Let’s explore the specifics of the deBridge Reserve Fund, how it works, and what it means for the future of deBridge.

Supporting the DBR Token Economy

The main goal of the Reserve Fund is simple: to support and improve the utility and long-term sustainability of the DBR token.

Since its pilot launch in June 2025, the Reserve Fund has started directing 100% of deBridge protocol earnings to obtain DBR via decentralized exchanges. This project is part of a larger plan to ensure that all components of the deBridge ecosystem work together synergistically.

In less than 50 days, the Reserve Fund has already accumulated over 1.35% of the total DBR supply, representing approximately $3.19 million as of July 24, 2025.

Track Reserve Fund activity on Solscan

Preserving and Growing Ecosystem Value

While DBR is currently the only asset held by the Reserve Fund, the fund may later start to diversify into strategically important assets that contribute to the strength of the deBridge DAO.

To increase the treasury’s capital efficiency and support DBR’s ecosystem role, balances are staked in leading liquidity protocols such as Kamino, Aave, and Lido. Meteora is also used to enable $6M+ of on-chain liquidity for the DBR-USDC pool, which generates an additional revenue stream for the DAO through trading fees and yield generated by automated provision of unused liquidity to lending protocols.

Enhancing Transparency

Crypto is nothing without decentralization and transparency.

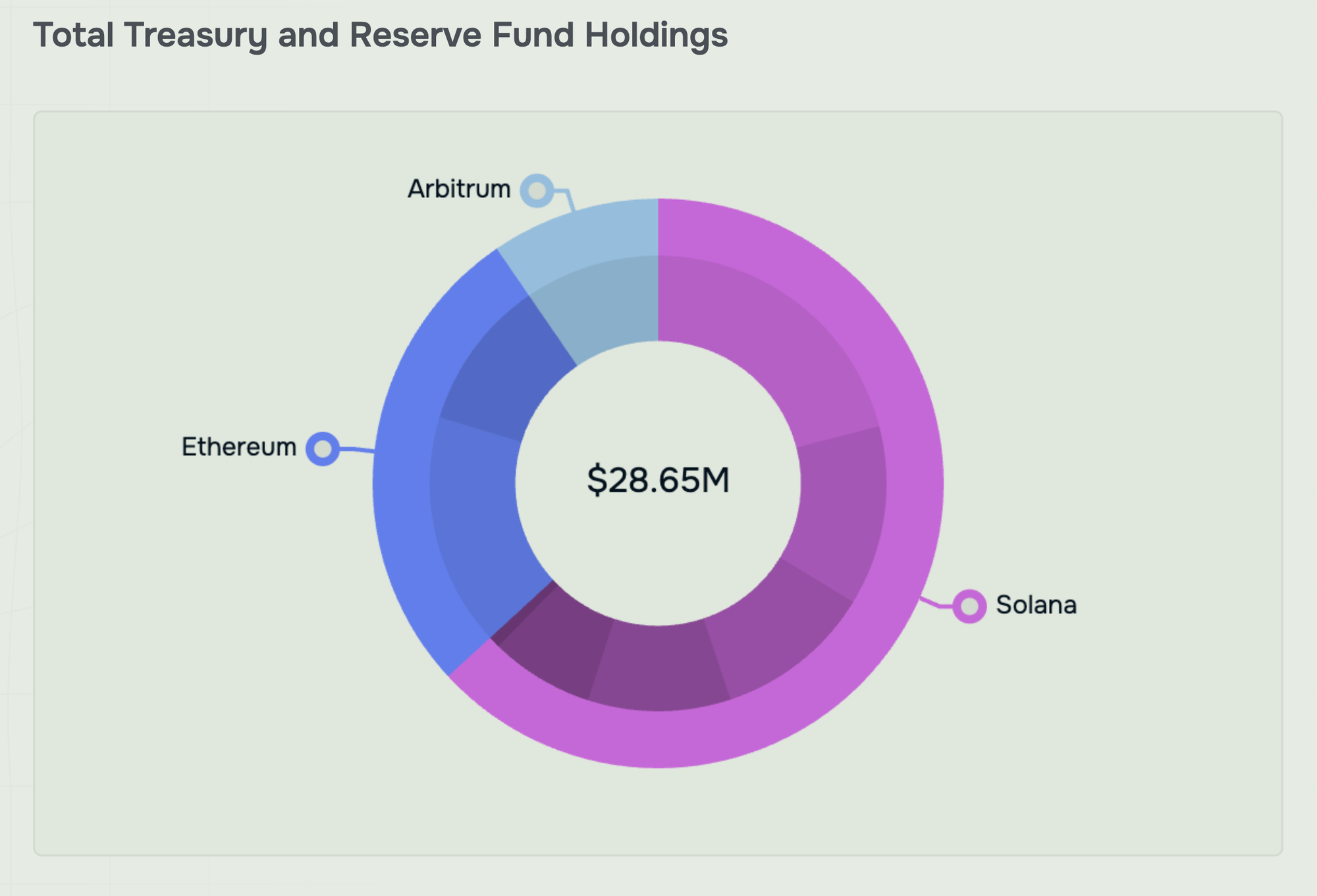

That’s why the Reserve Fund and the broader DAO treasury are now fully trackable by the community. This level of openness empowers token holders, developers, and partners to make informed decisions based on real-time data. As of July 24, 2025, the deBridge Treasury holds a diversified portfolio across multiple chains, including USDC, SOL, ETH, and DBR, accumulated through DRF.

Current combined holdings: $28.65M

All activity is publicly verifiable, and our dashboard provides deep visibility into token flows, acquisitions, and allocations.

Visit the deBridge Reserve Fund dashboard